Business

DWS fund makes a comeback – Allianz AI flagship crashes

The rating agency Scope Fund Analysis has published its latest evaluation of over 7,000 investment funds – with significant shifts at the top and bottom of the rankings. While the DWS Top Dividende, Germany's largest equity fund, climbs back to a C rating after two years in the relegation zone, the Allianz Global Artificial Intelligence falls to the lowest rating level, E.

DWS Top Dividend with Stable Comeback

The Fidelity US High Yield also celebrates a comeback: After a year and a half at C, the fund was upgraded back to B – thanks to controlled risk management and solid long-term performance.

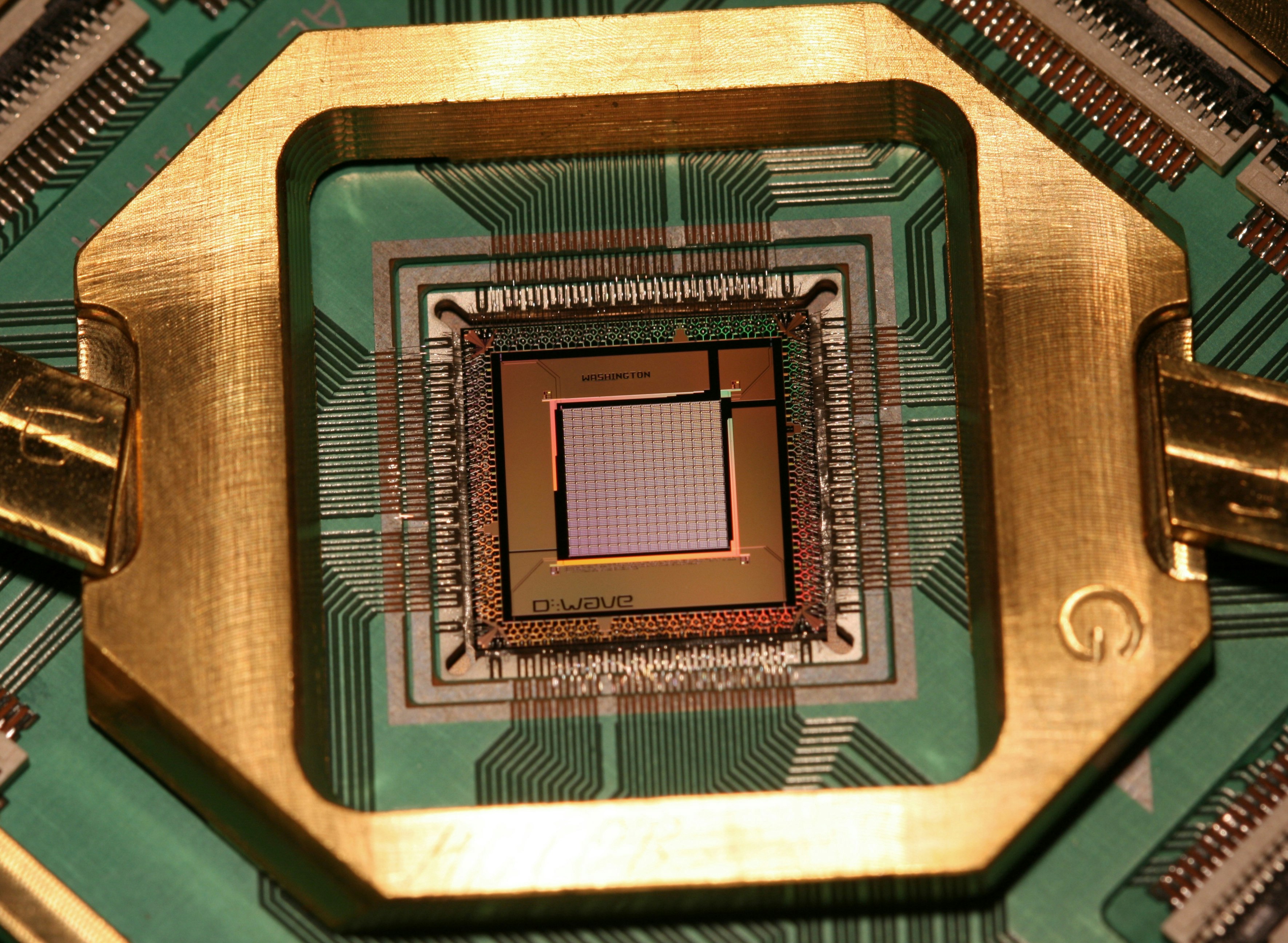

Allianz loses luster in AI category

Two funds from Morgan Stanley Investment Funds – Global Brands and Global Opportunity – also had to accept a downgrade, both from C to D. Once A-rated classics, they recently missed the industry average by a wide margin.

New Funds with Top Ratings

Market Overview: Gold and China on the Rise

In contrast, funds focusing on Switzerland, India, and Germany performed weaker. Overall, according to Scope, 10% of all funds currently hold an A rating, while around 11% are ranked at the lowest level E.

Conclusion: October shows a clear divergence in the fund market: defensive dividend strategies are regaining ground, while overheated technology themes are losing their luster.