Business

Nvidia plans AI chip for China in compliance with US export controls – Huang travels to Beijing for talks

In September, Nvidia will introduce an AI chip for China that strictly complies with US export controls.

Nvidia prepares to launch a new AI chip for China that complies with tightened US export controls. The modified processor is based on the Blackwell RTX Pro 6000 but is technologically stripped down. It lacks High Bandwidth Memory (HBM) and NVLink, key components for high-end performance, according to people familiar with the matter. The launch is planned for September.

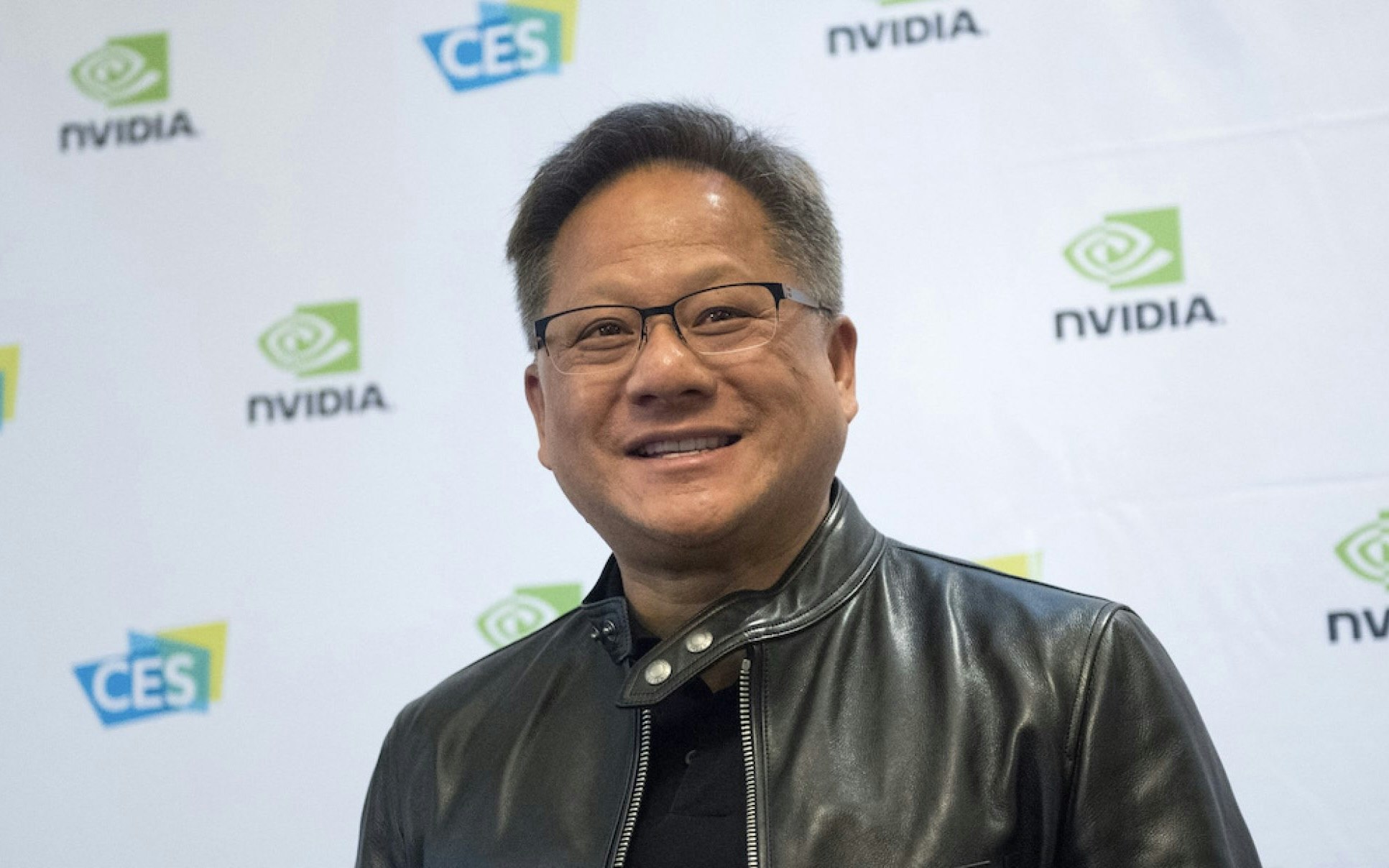

Group CEO Jensen Huang is expected in Beijing next week to affirm Nvidia's market presence at the International Supply Chain Expo and to hold talks with senior government officials. A meeting with Premier Li Qiang and Vice Premier He Lifeng is being prepared, according to insiders, but dates have not yet been finalized.

The visit underscores Nvidia's diplomatic efforts to stabilize relations with China after the company came under pressure from tightened US export regulations. Huang recently called the US controls a "failure" at Computex in Taiwan, as they accelerated China's development of its own AI chips. Nvidia's market share in China has dropped from 95 to 50 percent, according to Huang. Nevertheless, the company sees a market potential of up to 50 billion dollars there.

At the end of May, the USA further tightened export restrictions on AI chips like those from Nvidia. It wasn't until Washington sent signals for a relaxation in early July that Nvidia resumed planning for the China chip. They are still seeking legal certainty that the new chip will not be banned at short notice. The specifications could change depending on the outcome of the talks with Washington.

Customers in China are already testing the new chip. Despite limited performance compared to domestic high-end products, there is keen interest according to insiders. A switch away from Nvidia's Cuda software would be associated with significant costs for many Chinese customers. Nevertheless, companies like Alibaba, ByteDance, and Tencent are increasingly concerned about dependencies on US technology.

Unlike its predecessor H20, which was effectively banned in April forcing Nvidia to write off $5.5 billion, this time a larger inventory is expected to mitigate risks. China remains Nvidia's fourth-largest market with $17.1 billion in revenue in fiscal year 2025 and a 13 percent share of total revenue.

Nvidia itself did not want to comment on the specific plans. A spokesperson merely emphasized that China has one of the largest developer communities in the world. "All applications should run optimally on the US AI stack.