Business

Panama Canal Warns of Power Concentration from Mega Port Deal by MSC and BlackRock

MSC's port deal could undermine the neutrality of the canal and distort competition in the long term.

A planned port deal worth 23 billion US dollars raises sharp concerns for the Panama Canal operator.

The planned transaction poses the risk of a dangerous market concentration," said Vásquez. Access to the canal must remain guaranteed for all shipping companies under equal conditions. Otherwise, Panama's competitiveness could suffer significantly. He sees it as particularly critical that MSC, with the port accesses in the immediate vicinity of the canal, would gain vertically integrated control over significant transshipment points.

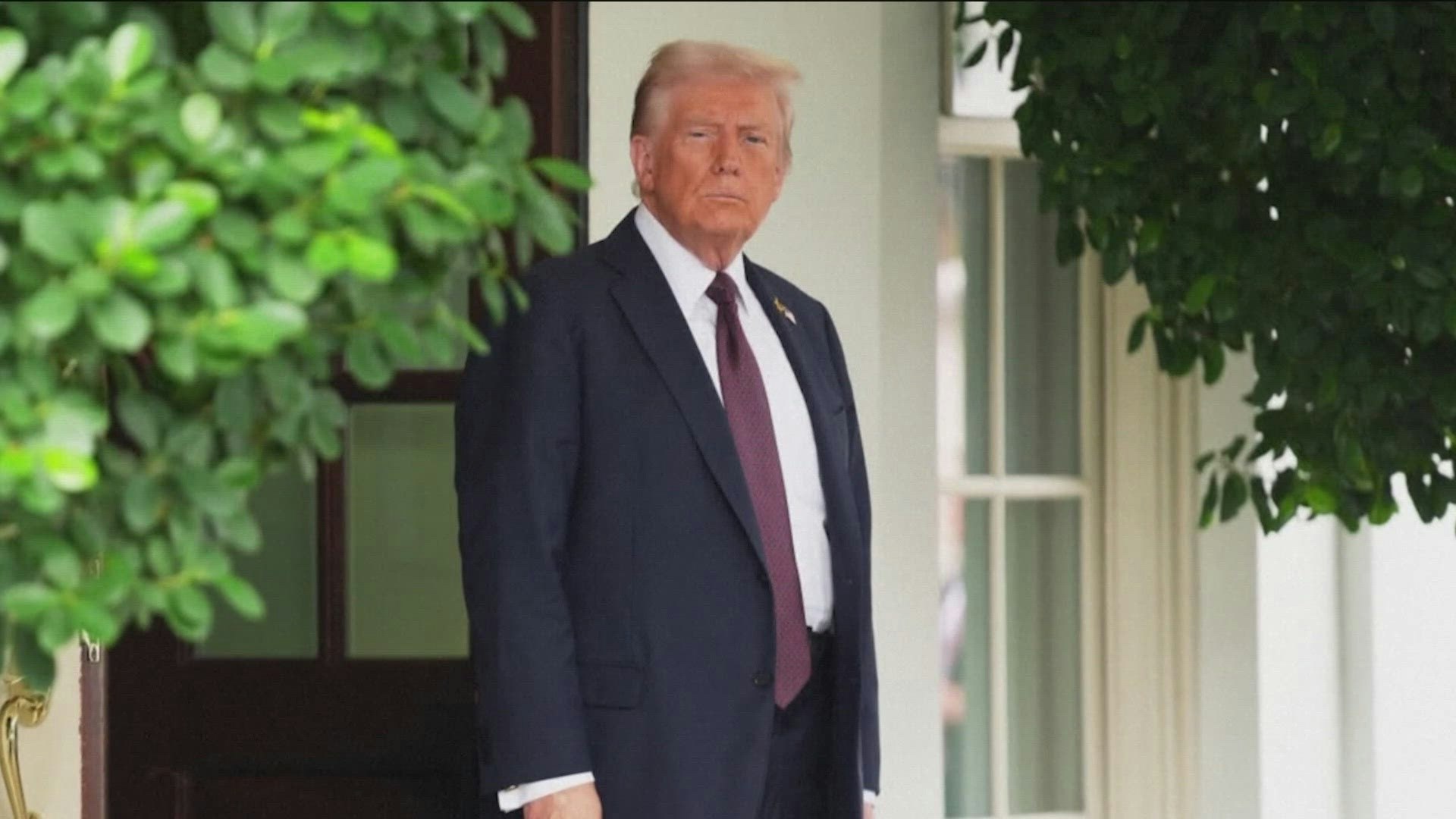

The geopolitical dimension of the debate is not new. Already during his term, US President Donald Trump lamented the withdrawal of American influence on the canal and threatened to reclaim it. A central point of criticism: the growing influence of Chinese companies, including Hutchison Ports, which currently control two of the five main port facilities in Panama. The fact that a consortium of Western investors now wants to take over these ports has triggered discussions with Chinese competition authorities.

Meanwhile, the deal accelerates the global competition for logistics corridors. Competitor A.P. Møller-Maersk secured control of the railway line along the canal in April. Vásquez speaks of a "hotspot for transshipment capacity" - while warning that the canal could lose container traffic due to the MSC acquisition if customers migrated.

Instead of watching idly, Vásquez advocates for a strategic response: The canal operator should reactivate the project to build its own container terminal in Corozal on the Pacific access – and act as the terminal operator itself.

At the same time, the authority is advancing diversification plans. In view of the record rainfall deficit of 2023, a pipeline project along the canal route is being considered. It is intended to transport up to 1 million barrels of liquid gas per day from the Caribbean to the Pacific coast. This could create urgently needed transit capacity for liquefied natural gas (LNG), whose demand is rapidly increasing. Due to drought and increased fees, the canal had recently lost many LNG customers.

Washington increases the pressure. The US government demands free access for US ships - a request to which Vásquez gives a clear refusal: "Even Panamanian naval units pay for passage. That is the law.